Another smackdown by Governor Palin via Facebook. While the Left radicals will stop at nothing to paint her as uninformed, Governor Palin continues to show herself to have a better understanding of the economy and the facts than apparently President Obama and the people intent on defending him.

I must admit that what I like best is that she writes that she looks forward to a debate with President Obama where "we'll" take on his fiscal insanity. Personally, I just look forward to her debating him--and 2012 would be soon enough for me!

Yesterday, PolitiFact.com fact-checked my statement about the coming $3.8 trillion Obama tax hike – the largest tax increase in history. They did such a bad job of it, however, that I feel compelled to fact-check the fact-checkers.

First of all, they claim that there are Democrat proposals which would “keep the tax cuts for individuals who make less than $200,000 and couples who make less than $250,000.”

Unfortunately for PolitiFact, no such proposal exists. They admit as much, by the way, when they state that “There are no formal congressional proposals yet to keep the Bush tax cuts in place, so we don’t have precise estimates from official sources like the nonpartisan Congressional Budget Office.” That doesn’t stop them, though, from claiming I “confuse the issue” by “using numbers that assume all the tax cuts are going away. That is not the Democratic plan nor is it President Obama’s plan.”

Plan? What plan? There is no plan. All we have is smoke and mirrors based on an old Obama campaign pledge that if elected, he would exempt families making less than $250,000 a year from “any form of tax increases.” But this pledge was already watered down before he was even elected. First vice-presidential candidate Joe Biden lowered it to $150,000. Then campaign surrogate Gov. Bill Richardson lowered it even further to $120,000.

A few months after the inauguration, even that last promise disappeared in a puff of smoke. When asked to reaffirm the White House’s commitment to the campaign promise of no tax increases for families earning less than $250,000, Obama’s spin doctor David Axelrod declared the President had “no interest in drawing lines in the sand.”

The truth is that as of today, Democrats haven’t taken any action to extend any part of the 2001 and 2003 tax cuts for any income group – and in this case doing nothing equals hitting American taxpayers with a massive $3.8 trillion tax increase.

What we do know for certain is that the White House is more than willing to raise taxes on families with incomes of less than $250,000. Democrat Senator Max Baucus admitted as much during the debate about Obamacare when he stated that “One other point that I think it’s very important to make is that it is true that in certain cases, the taxes will go up for some Americans who might be making less than $200,000.”

PolitiFact doesn’t dispute the $3.8 trillion estimate of the cost of repeal of the 2001 and 2003 tax cuts. It admits that “Palin’s estimate of $3.8 trillion over 10 years is within a reasonable range, if you’re talking about all taxpayers.” And yet somehow it continues to argue that I’m wrong, based on a proposal it admits doesn’t exist which in turn is based on a phantom campaign pledge which Democrats have already broken anyway. I call that a “Pants on Fire” statement.

To prevent PolitiFact from making similar mistakes in future, it would be helpful if the White House and the Democratic Congressional leadership finally mustered the courage to table their plans to let the 2001 and 2003 tax cuts expire. Mr. President, publish your proposals, and we’ll duke it out. You can argue in favor of a multi-trillion dollar tax hike in an age of economic uncertainty and mass unemployment, and we’ll argue for fiscal sanity combined with serious spending cuts. I for one look forward to such a debate.

In the meantime I suggest the St. Petersburg Times hires a few extra staff to fact-check its fact-checkers. It might help it prevent being caught with its “pants on fire” again in the future.

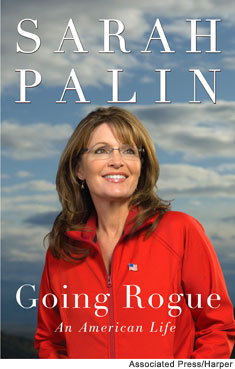

- Sarah Palin

No comments:

Post a Comment